Over the last several weeks, we’ve seen what Michael Mackenzie in the FT called a renewal of the market’s tortured dance with the Fed. The basic story seems to be that the Fed “moved policy to the sidelines” at its March meeting, causing market participants to discount any risk of a near-term rate increase. The Fed’s March minutes and a series of Fed speeches then returned a summer rate increase to the discussion. But just as the markets began to follow that lead, the bad jobs report led to a pirouette, dashing hopes/fears of near-term rate increases, and completing a bruising turn around the dance floor.

We’ve been telling a different in which there have been no policy surprises this year. And while the most recent jobs report was an unsettling surprise from the economy, we believe it causes no Fed pirouette. This is the same low-drama story we at the CFE have been telling since I returned to Hopkins a couple years ago after my time as special advisor to the Fed’s Board.[1] The main claims are these:

For nearly 3 years and right up until that latest jobs report, we’ve seen a bizarre constancy in the main summary of progress on the Fed’s dual mandate. Policy in response has been very consistent and, thereby, predictable.

Of course, these claims leave a bit of a puzzle about that tortured dance: Why is everybody so confused? I’ll mainly leave that for future posts, but the quick version is that the Fed wraps a coherent policy in a thicket of systematically confusing communications. This, in turn, provides the Fed’s volatile audience ample material to enthusiastically conjure what it may. I’ll ask you to read this post as if you ignore most Fed communication—as I do and as I’ve been recommending. For simplicity, then, imagine that you had tuned in only for the main event, the FOMC statements and post-FOMC press conferences.

After a recent FOMC press conference, the Fed chair offered the following summary:

The labor market has continued to improve, with gains in private payroll employment averaging about 200,000 jobs per month over the past six months… Inflation has been running below the Committee’s longer-run objective of 2 percent for some time…. The Committee believes that the recent softness partly reflects transitory factors, and with longer-term inflation expectations remaining stable, the Committee expects inflation to move back towards this 2 percent longer-term objective over time.

Well, recent may be stretching it: this summary is from Chair Bernanke in June 2013. But the quote could have come from any press conference for the last 3 years. At the most recent press conference, for example, Chair Yellen offered:

The labor market continues to strengthen. Over the most recent three months, job gains averaged nearly 230,000 per month, similar to the pace experienced over the past year. …[T]he earlier declines in energy prices and appreciation of the dollar could well continue to weigh on overall consumer prices. But once these transitory influences fade and as the labor market strengthens further, the Committee expects inflation to rise to 2 percent over the next two to three years.

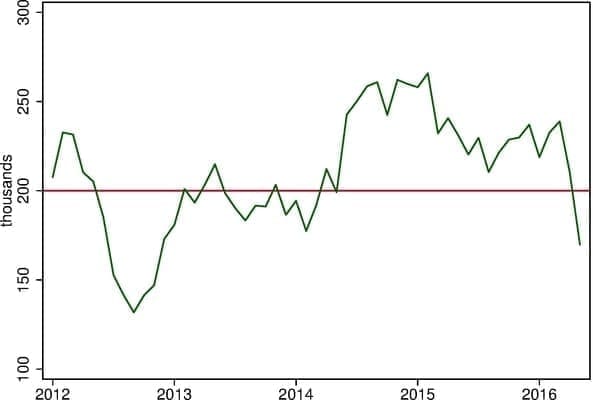

Up until this week’s FOMC meeting, at each for the past three years, the state of progress on the dual mandate has been this: continued steady job market gains as reflected in monthly nonfarm payroll advances near or somewhat above 200,000 (Fig. 1) and pesky transitory shocks holding down inflation but expected to abate. I suspect that the core policy developments have never been so static for so long.

A big part of my story about consistent policy in response to this steady backdrop rests on the fact that the FOMC is a large committee with 19 [2] people pulling in somewhat different directions. Under the last two Chairs, at least, the FOMC has strived to derive a policy plan that most all find acceptable. The 19 tug this way and that, and at any given moment various policymakers inevitably find cause for excitement—risk of skyrocketing inflation, disastrous deflation, financial bubbles, or overheating. But with the core policy backdrop unchanged, the consensus policy formed under the leadership of the Chair evolves very slowly and predictably.

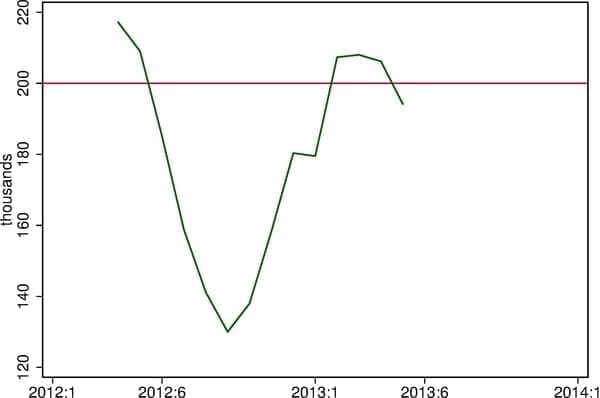

To understand the evolution of what I’ll call the Chair’s consensus over this period, it is probably helpful to start with policy backdrop at the outset. The economy had faltered in mid-2012 with 6-month average job gains falling below 150,000 (Fig. 2). This led the Fed to adopt QE3 and the thresholds for increasing interest rates, both of which had an element of open-ended support for the economy. By the time of the June 2013 FOMC meeting, though, job gains had rebounded. As Bernanke relates in his book, a hawkish contingent on the FOMC was becoming very insistent about forming a concrete plan for winding down accommodation. A dovish contingent continued to emphasize that inflation remained well-below target, that significant slack remained in the labor market, and that risk management considerations provided a reason to prefer too much over too little support for the economy.

Under the leadership of the Chair, the following compromise emerged. Announce a multi-year plan for gradual policy normalization to be followed so long as the economy behaves appropriately. The process would start earlier than the doves preferred, but the announced pace under the modal scenario would be more gradual than the hawks wanted. Importantly, continued steady gains in the job market were the key to both sides of the dual mandate. Steady job market gains, if continued for several years from 2013, would take the economy near or beyond reasonable estimates of maximum sustainable employment. The tightening of the labor market would—in combination with anchored inflation expectations—provide a main impetus for inflation’s return to 2 percent.

To oversimplify a bit, these various forces led to a Chair’s consensus evolving as if guided by rock-solid adherence to two principles:

So long as steady job market gains persist, continue a gradual, pre-announced removal of accommodation.

So long as inflation remains below target, take a tactical pause if credible evidence arises that the job gains might soon falter.

As I’ll document, we’ve seen a steady removal of accommodation roughly according to an announced plan, with policy steps that have been a bit delayed due to tactical pauses. Up to now, the warnings that job gains might falter have proven to be false alarms, and the pauses have been brief.

Consider the plan that the FOMC deputized Bernanke to lay out in June 2013:

Going forward, the economic outcomes that the Committee sees as most likely involve continuing gains in labor markets, supported by moderate growth that picks up over the next several quarters as the near-term restraint from fiscal policy and other headwinds diminishes. We also see inflation moving back toward our 2 percent objective over time. If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear.

What happened? The taper began later that year, in December, and purchases were at an inconsequential level (from a macro perspective) by mid-year 2014. Purchases ended in October. The policy outcome was a modestly delayed version of the announced plan. And the modest delay was not the quirk of a mercurial Fed.

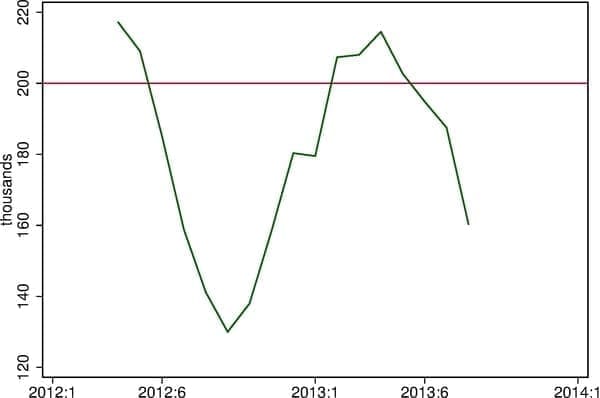

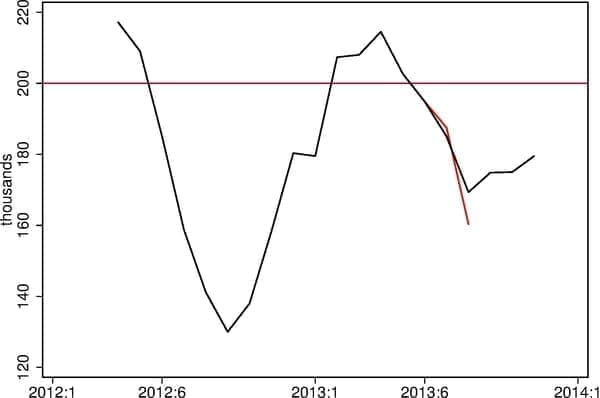

While monthly job gains were near 200,000 when Bernanke laid out the plan, job gains immediately appeared to plummet. By the time of the September FOMC meeting, the latest data had six-month average gains near 150,000 and falling—looking suspiciously like the swoon of 2012 (Fig. 3). By the time of the December FOMC, however, the gain reported in September had been revised up considerably, and subsequent data had turned in a favorable direction (Fig. 4). The pause was brief, the taper proceeded, and purchases ended on a slightly delayed version of the announced plan. In short,

So long as steady job market gains persist, continue a gradual, pre-announced removal of accommodation.

So long as inflation remains below target, take a tactical pause if credible evidence arises that the job gains might soon falter.

After purchases ended, the next big step in normalization was interest rate liftoff. And at this point, I had returned to the CFE and was using the perspective I’m describing here to explain and predict policy. Just before the March 2015 FOMC, <href=”http: krieger.jhu.edu=”” financial-economics=”” 2015=”” 03=”” 1825=”” “=””>I summarized how the consensus had evolved in Yellen’s first year as Chair: </href=”http:>

FOMC communication about lift off since [Yellen became Chair] … has been remarkably consistent, with the basic formulation remaining unchanged… Under the framework the FOMC seems to have been following, and barring significant surprises that sharply alter the outlook, the precise date of lift off seems likely to remain between June and the end of the year.

Of course, the actual timing of liftoff was at the back end of this window. The tactical pause in this case came after financial turmoil erupted in international markets in August, accompanied by worrisome international data. As Yellen explained at the September press conference, “The economy has been performing well, and we expect it to continue to do so.” But the FOMC would to take a pause in light of “heightened uncertainties” in order to confirm that the job market gains were still on track.[3] By December, with the data confirming no real change in the direction of the job market (Fig. 1), we got liftoff.

As matter of historical description, we’ve seen a gradual removal of accommodation according to a modestly delayed version of plan that was communicated pretty clearly in advance in the FOMC statement and press conference. The delays have come in response to credible evidence about risks to job market progress.

And so we come to 2016. In this phase, the steady dialing back of accommodation comes in the form of a gradual rise in the policy interest rate. Following renewed market turmoil early this year, we noted in January that under the pattern of recent FOMC behavior, the turmoil would cause no fundamental change in Fed policy, but that the FOMC might signal a tactical pause. A couple months later at the first press conference of the year, Yellen stated that the “baseline expectations for economic activity, the labor market, and inflation have not changed much since December” but that the FOMC was proceeding cautiously, in order to ‘’verify that the labor market is continuing to strengthen despite the risks from abroad.” More of the same.

This week, for the first time in the last 3 years, the FOMC meets as a tactical pause has been followed by troubling jobs data. The data as they stand going into the June FOMC show the largest drop in the pace of job gains since the swoon in 2012 that kicked off this period (Fig. 1). (To appreciate the news in the last report, note that six-month average gains as of the May report stood at 220,000 and now stand at 170,000.) But the news in one jobs report essentially never warrants a policy pirouette. If the FOMC follows the pattern it has reliably followed, it will once again state that it is awaiting evidence regarding whether this disturbing blip is something more than a blip. If the data resolve as they did in 2013, the pause will again be brief.

Chair Yellen’s speech last Monday was pretty much what one might have expected under this perspective. Indeed, back when I was advisor to the Board, I helped write these things and the main ingredients have not really changed. One jobs report never sharply shifts the outlook. By many indicators, the economy is still quite healthy. Inflation is still too low and continued decent jobs growth remains a central pillar supporting the case that inflation will return to 2 percent. Risk management considerations still favor providing too much over too little support for the economy. And so forth. The speech was neither hawkish nor dovish, instead it looked to me like a straightforward reflection of the two principles:

So long as steady job market gains persist, continue a gradual, pre-announced removal of accommodation.

So long as inflation remains below target, take a tactical pause if credible evidence arises that the job gains might soon falter.

Let me emphasize that these principles describe policy behavior along one narrow scenario: steady job gains continue and inflation remains too low. This scenario just happens to be the narrow scenario that the economy has bizarrely followed for 3 years—at least up until the latest jobs report. Going forward, if the economy falters or booms, or if inflation moves decisively in either direction, we will again be facing unprecedented conditions and the FOMC will face the challenge of communicating a new strategy in response to the new environment. For now, no strategic upheaval, just a tactical pause.

Back to that tortured dance. (You can now restore all your memories of the confusing body of Fed communication and tumultuous record of market reaction over this period.) My low-drama account of the evolution of the Chair’s consensus simply and reliably accounts for policy over this period. The story of how straightforwardly predictable policy gets lost in the thicket is the subject of the next post, entitled ‘Why is transparency so damn confusing?’

Post script: Wary of contributing to the tortured dance myself, let me mention two natural misimpressions that might come from this post. First, I have told the story of the job market focusing on one indicator, nonfarm payroll gains. This important indicator does not play the exclusive role it has played this account. Over this period, nonfarm payrolls happen to provide a convenient summary of the key features of the full body of indicators. Second, the expression, the Chair’s consensus might leave the misimpression that policy mainly reflects the views of the Chair. You can read Chair Bernanke’s book or the book Chair Yellen is yet to write to assess the degree to which this was true over this period. In this label, I mean to convey a simpler point that many of you can probably confirm from personal experience: a large, diverse committee would seldom if ever arrive at consensus without constructive leadership. On the FOMC, the Chair provides this leadership. In modern squishy parlance, Chair’s consensus should probably be read as Chair-nurtured consensus.

Notes:

1. I began posting comments on this account of policy soon after returning to the CFE in the fall of 2014. The most recent installment came after the March FOMC, but the story has not changed. [back]

2. Here, 19 is a stand in for however many seats happened to be filled at any given time. It’s been more like 17 recently. [back]

3. From the September press conference:

However, in light of the heightened uncertainties abroad and a slightly softer expected path for inflation, the Committee judged it appropriate to wait for more evidence … Now, I do not want to overplay the implications of these recent developments, which have not fundamentally altered our outlook. The economy has been performing well, and we expect it to continue to do so. [back]