Robert J. Barbera and Jonathan H. Wright

We’ve written two pieces recently on Treasury yields amid the COVID recovery. Wednesday’s release of the Federal Reserve Open Market Committee’s Survey of Economic Projections is an opportunity to review where ten yields are, and where they may be headed.

The median FOMC participant projects a funds rate at 0 through the end of 2023 and a long run neutral nominal funds rate of 2.5%. Let’s suppose that investors agree with these expectations. Additionally, let’s suppose that fed funds liftoff starts in 2024 and that the rate reaches 2.5% by the end of 2025. Then that gives an average expected short rate over the next 10 years of 1.5%.

Yields on long duration Treasuries, historically, have been well above the average of yield of overnight rates and the term premium was typically thought to be positive. Very much at odds with that history, however, both the muted recovery after the Great Recession and the collapse for activity, amid COVID-19, collapsed term premia—in fact, for a time mid, 2020, term premia looked to be negative.

Estimates of term premia are up from the negative levels that they reached last year as the risk of a prolonged stagnation loomed large, but are still below the levels that existed before the Great Recession. A term premium near zero seems quite reasonable around now. Investors’ expectations for the future for fed funds sketched out above, coupled with a plus 20 basis point term premium can fit today’s 1.7% 10-year yield.

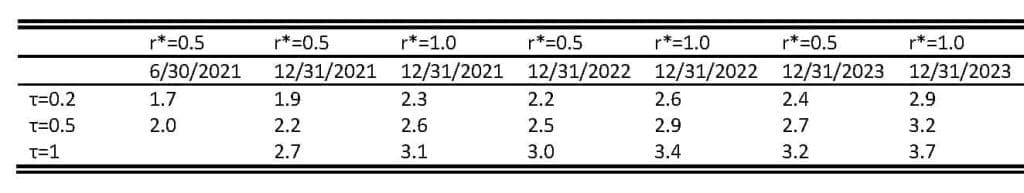

What might the yield on the 10-year do, again accepting our version of the Fed’s 10-year view, over the next few years? Suppose that everything plays out exactly as expected and that there is no change in term premia. Ten-year yields will climb as the period of zero fed funds shrinks, and the period approaching the neutral fed funds rate expands. This mechanical effect means that the ten-year yield would climb to 1.9% by the end of the year, 2.2 percent by the end of 2022 and 2.4 percent by the end of 2023.

Other things, however, could well change. Blanchard, Cerutti and Summers (2015) argued that large recessions could lower the potential growth rate of output. Turning this logic around, running the economy super hot in 2021 and 2022 might raise that potential growth rate, and hence r*, the equilibrium real short-term interest rate. The ten-year yield that would be consistent with this higher r*, would of course, be higher as well.

And then there is the term premium. We think that the increase in rates so far this year owes a lot to a rising term premium as the tail risk of perpetual stagnation gets replaced with the more traditional tail risk of an overheating economy. Over the period from 2004 to 2007, the model of Kim and Wright (2005) put the ten-year term premium at plus 50 basis points and going back to that alone would get the ten-year yield to 2.7 by the end of 2023. Going back further to the years around 2000, the Kim and Wright term premium estimate was around plus 100 basis points. We sketch out, in the table below, some scenarios for the 10-year yield. A neutral real short rate, r*, in concert with the median Fed participant’s expectation, centers the 10-year rate at 2%, as long the term premium stays near zero. A return to even a modest 0.5% term premium, (tau), and the 10-year settles in at rates around 2.5%. If better times persist, following the fiscally-fed boom of the next few years, then r* jumps and a 3% 10-year comes into view. And if term premia return to strong economy values, circa 2000?

The bottom line is that with really strong GDP growth (a very strong likelihood over the next year or two), there are several ways in which a ten-year yield of 3% could come into view by 2023, with absolutely no change in mean expectations for inflation. Thus, in and of itself, there is nothing remotely alarming about a 3% yield. That is the level that was in place in 2018, and such low rates were unheard of before the Great Recession and the moribund recovery that followed.