Was the recently enacted Biden stimulus package too large? Is it likely to produce an economic boom so large that it does real damage? And is that damage even more likely if President Biden is able to get a lot more spending through Congress?

We don’t think so.

Using orthodox analysis, it is easy to reach the opposite answer. Accelerating wage and price increases, in the conventional model, are the preeminent risks that attend running the economy “hot.” If fiscal stimulus proves excessive, it will threaten inflation and necessitate some tightening of monetary policy. Tighter monetary policy, in turn, is bad news, in that it increases the risk of recession. Thus, super-sized stimulus for many economists wed to this painfully incomplete framing, looks to be unnecessarily risky.

What is missing from this framing? A realistic debate must come to terms with some painful economic realities:

- Assessments of output gaps are highly problematic.

- Asset market inflation can also destabilize, and many asset prices, today, are excessive.

- Monetary policy, today, is wildly accommodative, and is desperate for a near term exit.

From a CFE perspective, the failure to consider asset market/monetary policy dynamics when formulating macroeconomic policy, is particularly glaring. CFE was formed, in 2007, precisely because we judged that finance and macroeconomics had grown too far apart. Awarding Wall Street a central role in macroeconomic thinking certainly gained some support after the Great Recession. Unfortunately, asset market considerations remain remarkably absent from most macro policy debates. If analysts acknowledge that asset market excesses can be just as destabilizing as wage and price inflation, the case for super-sized fiscal stimulus, becomes much more compelling[1].

Estimates of U.S. full employment and production potential are highly problematic. If we conjure conservative estimates about upside potential and chart a course that extends tepid expansion—the disappointing reality of the last recovery—we may well be denying ourselves much better times, for no good reason. Outsized stimulus allows us to find out, not conjecture about, the size of the output gap. Going really big will reveal just how much room there is to boom.

And going big, fiscally, offers us a potential way out of today’s unusually divergent Main Street/Wall Street circumstances. Normally big excesses on Wall Street begin to materialize after a reasonable run of good times in the real world. But asset markets, using a host of metrics are currently flashing signs of striking excess. In stark contrast, conditions on Main Street must still be characterized as very poor. Ideally, the net effect of government policies, over the next few years, will be very stimulative, to aid recovery for the real economy. Enacting a fiscal thrust that, absent interest rate changes, is likely to be too big, invites a combined policy of aggressive and direct Main Street stimulus via fiscal policy and some restraint from Fed policy. In such circumstances, you provide the Federal Reserve with an exit strategy from its current unprecedented level of accommodation. It amounts to an opportunity to deflate today’s Wall Street excesses amid a Main Street boom that can handle it. Thus, a fiscal policy move that requires some countermanding interest rate increases is not a bug—it’s a feature.

The Size of the Output Gap

The Congressional Budget Office, in January, offered an outlook that assumed no additional stimulus in 2021. They estimated that real GDP was 3% below potential in the fourth quarter of 2020, and that the 6.8% jobless rate, in turn, was well above full employment, which they estimated to be 4.5%.

Suppose we accept CBO’s 4.5% NAIRU estimate, their modest expectations for labor force participation rate recovery, and their 1.7% rate for prospective productivity gains. Modest fiscal stimulus, around $400 billion, delivers two years of real GDP growth of 3.7%/year. Over the two years a shade less than 7 million jobs are created and the jobless rate falls to 4.5%.

A $2 trillion stimulus package? Insist on CBO’s output gap and long run productivity trajectory estimates and assume the Fed and financial markets ignore widespread overheating and we get a nonsense outcome. The economy registers two years of 6% annualized growth and the jobless rate, near impossibly, ends 2022 at ZERO.

Of course, that won’t happen. Larry Summers embraces CBO’s January notions about output gaps and productivity performance, and sketches out the dismal additional dynamics that likely will prevent the improbable plunge for joblessness: a big rise for inflation, a surge for interest rates and a catastrophic plunge on Wall Street. These are some of the nasty outcomes one must contemplate to make things add up in such circumstances.

But How Much Room is there to boom?

Precisely because super-sized stimulus invites boom, we need to rethink our views about how key economy metrics historically perform in a boom. For starters, boom times are characterized by outsized gains for labor productivity, labor force participation, and net immigration. If we raise our sights on these key variables, we can justify penciling in much higher output gaps, and much more room to boom.

When was the last time the U.S. boomed, amid major fiscal stimulus and high joblessness? One needs to go back to the early 1980s. Over the eight quarters ending 1984:Q4 real GDP grew at a 6.7% annualized rate and productivity advanced at a 2.7% annualized pace. Similarly, gains for labor force participation rates, in robust growth periods, are generally impressive.

One additional upside possibility? Net immigration, hardly surprisingly, collapsed over the four years of the Trump presidency. Over the previous 20 years, net immigration accounted for half of the growth rate for U.S. working age population. Amid a job creating boom, mightn’t there be some lift for population growth?

Lastly, and quite importantly, the Fed and financial markets will not ignore a two-year boom. Suppose interest rates rise and risk asset prices correct, amid the traditional boom related jumps for productivity, participation, and net immigration. One can imagine real growth averaging around 6%, 11 million net job creation with the jobless rate around 3.5% as 2022 comes to a close.

‘Not Knowing’, Is Not the Same as ‘Knowing Nothing’

John Kenneth Galbraith offered us the following wisdom:

“There are only two kinds of economists, those who know they don’t know, and those who don’t know they don’t know.”

We certainly don’t know if all or any of the possible cyclical pops outlined above will eventuate. But Larry Summers, Olivier Blanchard and other mainstreamers don’t know that they won’t.

One thing, however, we do know. Outsized stimulus allows us to find out, not conjecture about, the size of the output gap. Going really big will reveal just how much room there is to boom.

And the Bonus from Super Stimulus? Dealing with Dangerously Inflated Asset Prices

The mainstream economist fixation on wage and price inflation, as the central risk to expansions, is, from CFE’s perspective, striking. Asset market bubbles, not wage and price pressures, have been the destabilizing excesses that drove every major global boom and bust cycle, 1989-2009. The 1990 U.S. recession, intimately linked to the junk bond collapse and the S & L Crisis. Japan’s spectacular asset market collapse, circa 1990. The Asian contagion, mid-1990s. The technology share price bubble, 1999-2000. And the fantastic bubble for residential real estate prices, 2004-2007, ushering in the Great Recession.

There were no wage/price spirals. No virulent union demands leading to big strikes, climbing costs and the need for ever more aggressive Fed restraint. Quite the contrary. Rescuing the U.S. economy from the deflationary forces of each successive burst bubble required ever more aggressive easing action; ever lower interest rates, and when the zero bound was hit, treasury bond buying after the Great Recession. The Fed’s spectacular rescue, in the aftermath of the COVID-19 economic collapse involved enormous buying of treasuries and, upping the ante once again, the outright buying corporate bonds. Perhaps the most telling statistic for 2020 was the fact that U.S. corporate bankruptcies, traditionally surging amid recessions, actually fell.

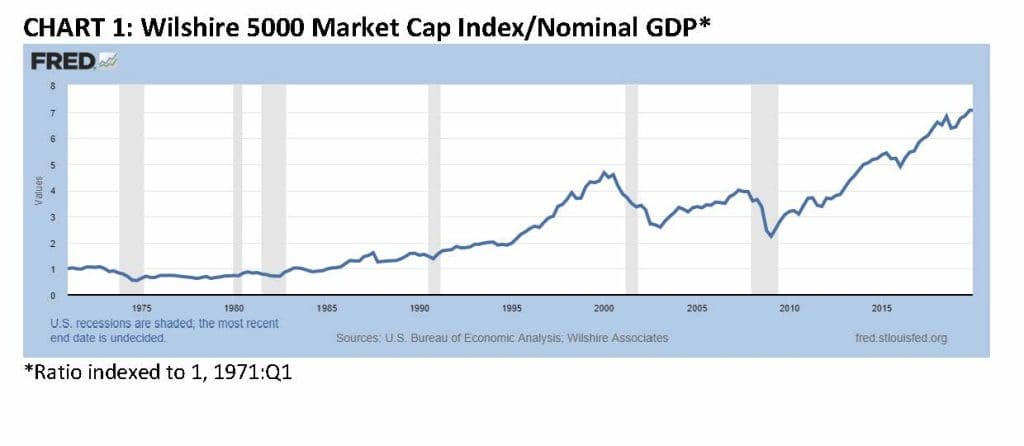

What traveled hand and hand with this stepwise move to ever more spectacular Fed backstopping of risk taking? Clearly, risk asset gains have delivered less and less income bang for the asset market buck (see chart 1).

We end where we began. Tepid recovery and continued super monetary policy accommodation, is a recipe for wild asset market excess in the years directly ahead. A fiscally enhanced boom affords Main Street serious upside, puts some distance between short term interest rates and zero, and corrects high flying asset markets. That could well be the least costly way to get out from under today’s risky asset market prices. And it may begin a welcome move to an interest rate regime that reinstates the U.S. Federal Reserve as the entity largely in charge of attending to the cyclical ups and downs of the U.S. economy.

[1] Of course, any forecaster today must offer caveats related to the risks attending wildfire rest-of-world COVID-19 spread. With global opportunities for mutation, sadly, quite high, we cannot dismiss the possibility that a new vaccine defying variant will appear. If that horrific event transpires, all of today’s wrangling about just how big a boom the U.S. can handle will be monstrously off the mark.