By Bob Barbera and Jon Faust

The July snapshot of U.S. employment suggests that job gains have slowed to a crawl, with three-month average gains down to 35,000. Days before the jobs report Fed Chair Powell argued that “a wide set of indicators suggests that conditions in the labor market are broadly in balance and consistent with maximum employment.” Can that still be right? On Friday, after the jobs report, FOMC Vice Chair Williams struck very much the same tone as Powell had. But really, can that be right?

The possibility of data manipulation is nonsense (for now). Even so, the revised data could be a head fake, and job gains will rebound in the next few months. But we have some other measures of job gains that support the notion that non-farm payrolls, before revision, likely overstated strength. The employment sub-indices of ISM surveys and the ADP tally of private employment all show material slowing over the past several months.

In a CFE post last February, we suggested another reason that materially slower job gains could be consistent with maximum employment. The post highlights the Census Bureau’s 2025 detailed projections for U.S. population growth. In two scenarios, they assume sharp curtailment of net immigration, and for both cases, this translates into near-zero expansion in the U.S. working age population. We noted that absent a rising labor force participation (LFP) rate—in practice, LFP has been declining—this would drive the breakeven rate of job growth to near zero. That’s the rate required on average to hold the unemployment rate constant.

Definitive data on net immigration could help resolve this question, but those will not be forthcoming for some time. For now, we have to look to related data for signs of whether job gains have fallen below the breakeven rate. As Williams and Powell emphasized, the unemployment rate has not risen. It is true that falling participation prevented the unemployment rate from rising a few tenths. Jobless claims, however, echo the message embedded in the stable jobless rate, as, to date, they have barely budged.

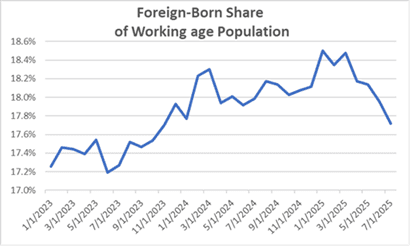

One additional bit of data that provides indirect evidence on this question is the BLS data on the foreign-born share of the working age population (Fig. 1). This share shot up in 2023 and 2024, a period in which Census data subsequently confirmed that net immigration had driven a big jump in the growth rate of the working age population (WAP). The foreign-born share is now plunging consistent with a significant drop in the growth rate of the WAP, a drop similar to those in the 2025 Census forecasts discussed above. We’ve been watching this share fall for a few months, but the series is noisy, and a few months of decline don’t necessarily mean anything. As of the latest jobs report, however, these data are looking more like a smoking gun.

Come to think of it, smoking gun is the wrong allusion. Smoking guns provide clues to mysteries. A big drop in net immigration would be no mystery: it’s pretty much the official policy of the U.S. government.

One factor which could boost the breakeven rate is a rebound in the labor force participation rate. The drop in the participation rate has been concentrated among the foreign-born, and this seems unlikely to reverse under current policies. But the native-born participation rate has also dropped some, and reversing that drop could raise the breakeven rate for a time.

Despite the fact that the data are not definitive, the breakeven rate of job growth is front and center for monetary policy. If job gains have fallen far below the breakeven rate, unemployment will soon be rapidly rising and the modestly restrictive stance for policy should perhaps be neutral or even accommodative. On the other hand, if the breakeven rate has fallen in line with job growth, adding stimulus would push a balanced job market toward overheating and complicate the Fed’s efforts to bring inflation back to 2 percent. Unless the next jobs report or other data sharply change the picture again, this is likely to be one of the hot topics at the September FOMC meeting.